Denim fabric continues to dominate the global denim trade in 2024, serving as a core material in jeans, workwear, and apparel across markets. As demand grows for sustainability, speed, and supply chain diversity, businesses involved in denim fabric sourcing and manufacturing must understand the latest global denim fabric trade trends.

This report provides a detailed, data-driven overview of the 2024 denim fabric market, highlighting the top denim fabric exporters and importers, key market drivers, and strategic insights. Whether you’re a supplier or buyer, the following analysis will help you navigate the denim industry’s evolving global landscape.

The article is structured into the following key sections:

1. Global Denim Fabric Market Size 2024: Denim Industry Growth and Production Output

2. Top Denim Fabric Exporters in 2024: China, India, Pakistan, Turkey & More

3. Major Denim Fabric Importers 2024: EU, USA, Vietnam & Mexico Market Demand

4. 2024 Denim Trade Snapshot: Global Denim Export vs Import Comparison Table

5. Key Trends in Denim Fabric Trade 2024: Sustainability, Speed, and Compliance

6. Opportunities and Risks for Denim Suppliers and Buyers in 2024

7. Strategic Insights for Denim Businesses: How to Compete in 2025

8. Future Outlook: Global Denim Fabric Market Forecast Through 2025–2028

9. Conclusion: Key Takeaways from the 2024 Global Denim Fabric Trade Report

1. Global Denim Fabric Market Size 2024: Denim Industry Growth and Production Output

As of mid-2024, the global denim fabric market size is estimated to be USD 21.5 billion, recovering from a slight dip in previous years due to macroeconomic uncertainty and shifting consumer demand. The total global production is approximately 63 billion meters, with over 55% of this output concentrated in Asia—primarily China, India, and Bangladesh.

Denim continues to be one of the highest-volume categories in the woven fabric segment, with demand driven by ready-made garment (RMG) hubs, fashion brands, and regional buyers seeking a balance between price, quality, and compliance.

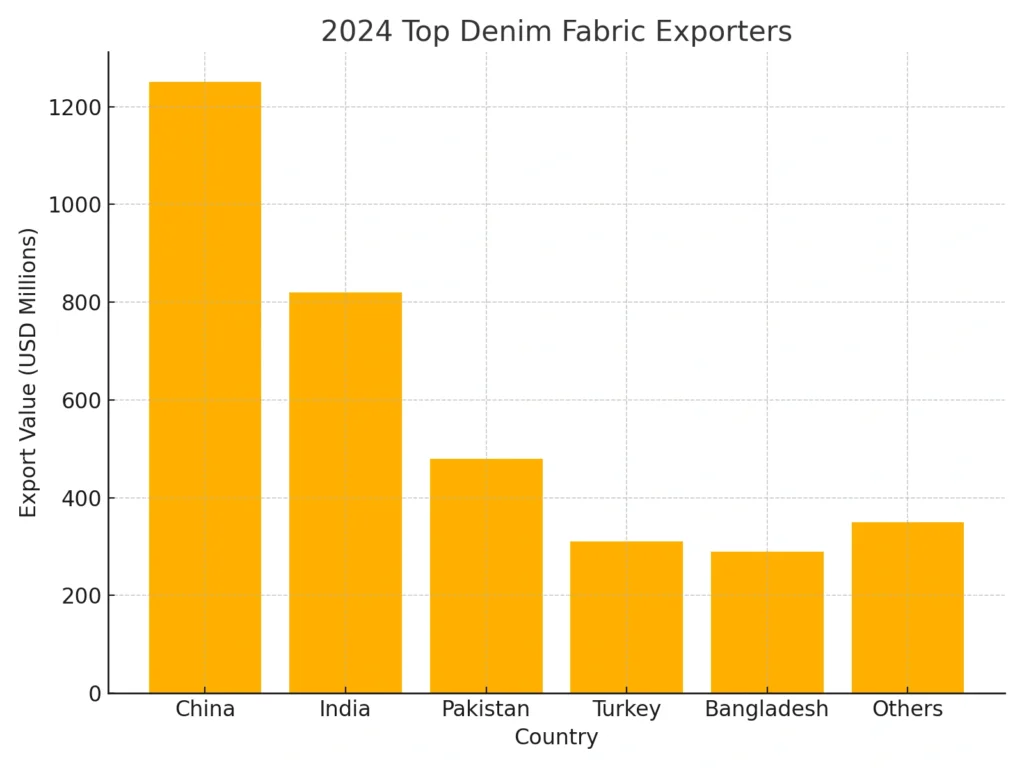

2. Top Denim Fabric Exporters in 2024: China, India, Pakistan, Turkey & More

In 2024, the global denim fabric export market continues to be dominated by a handful of major textile-producing countries, each contributing with its own competitive advantages.

| Category | Country | Value (USD) | Global Share (%) |

| Export | China | 1.25 B | 35.2% |

| Export | India | 820 M | 23.1% |

| Export | Pakistan | 480 M | 13.5% |

| Export | Turkey | 310 M | 8.7% |

| Export | Bangladesh | 290 M | 8.2% |

| Export | Others | 350 M | 9.3% |

| Import | EU | 1.08 B | 30.9% |

| Import | USA | 850 M | 24.3% |

| Import | Japan | 320 M | 9.1% |

| Import | Vietnam | 280 M | 8.0% |

| Import | Mexico | 250 M | 7.1% |

| Import | Others | 720 M | 20.6% |

China – Market Share: 35.2%

China remains the world’s largest denim fabric exporter, generating approximately USD 1.25 billion in export value. With its vertically integrated supply chain, massive weaving capacity, and competitive pricing, China leads the way in both volume and variety—ranging from classic rigid denim to advanced eco-stretch fabrics. The country continues to be the go-to source for bulk sourcing and rapid production turnaround.

India – Market Share: 23.1%

India ranks second with an estimated USD 820 million in denim fabric exports. Indian manufacturers are increasingly investing in value-added finishes, including printed, textured, and recycled denim options. Backed by a strong domestic cotton base and growing sustainability certifications like GOTS and BCI, India is positioned as a preferred supplier for buyers seeking creative, eco-conscious products.

Pakistan – Market Share: 13.5%

With around USD 480 million in denim exports, Pakistan specializes in cost-effective, bulk-washable denim. Its strengths lie in vertical integration, high-volume production, and a strong track record with European and North American buyers. Many Pakistani mills also offer flexible MOQ programs and pre-washed options.

Turkey – Market Share: 8.7%

Turkey exported approximately USD 310 million worth of denim fabric in the first half of 2024. Thanks to its geographic proximity to Europe and its advanced design capabilities, Turkey has positioned itself as a top supplier of premium, fast-delivery denim. Brands seeking speed and compliance often turn to Turkish mills for custom developments.

Bangladesh – Market Share: 8.2%

Traditionally known as an importer, Bangladesh is now emerging as a competitive denim exporter, reaching around USD 290 million in 2024. With growing domestic weaving capacity and rising sustainability investments, Bangladesh is moving toward becoming a self-sufficient player in both garment and fabric supply.

Other Countries – Market Share: 9.3%

Countries like Vietnam, Egypt, and Mexico are steadily growing their export presence, collectively contributing nearly USD 350 million. These regions benefit from trade agreements and regional proximity to major import markets like the U.S. and EU.

Overall, the denim fabric export landscape in 2024 is shaped by a mix of scale, innovation, and speed, with Asia maintaining its leadership while regional hubs gain traction.

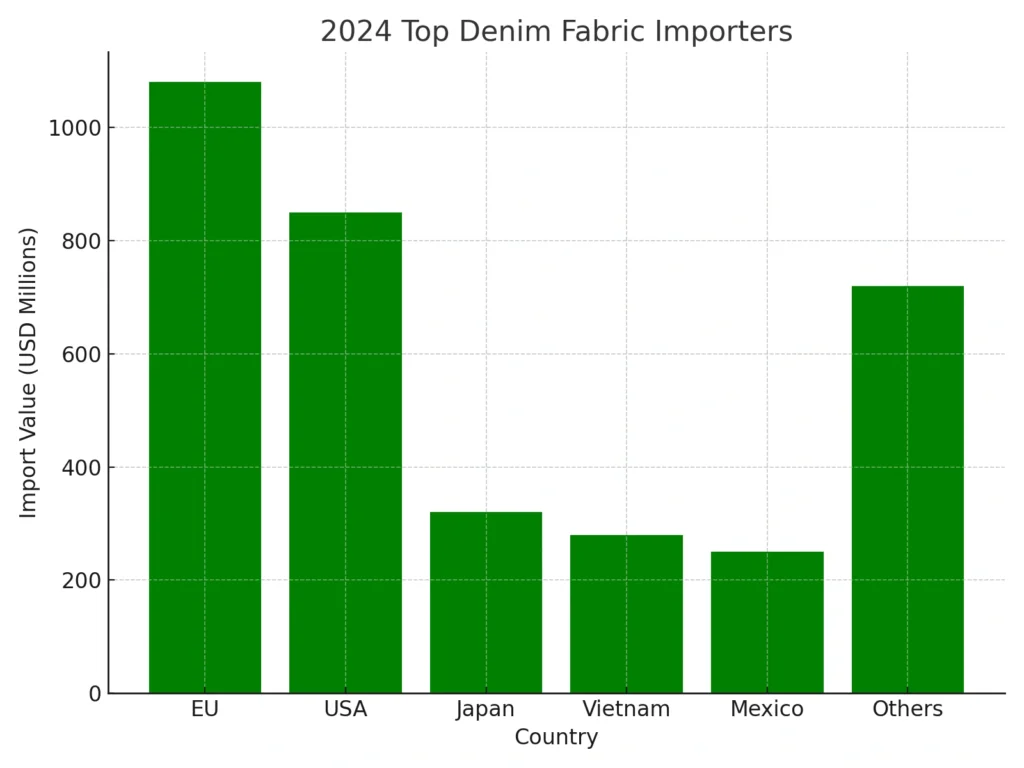

3. Major Denim Fabric Importers 2024: EU, USA, Vietnam & Mexico Market Demand

Denim-consuming countries continue to rely heavily on imports to meet domestic garment manufacturing needs and market trends. In 2024, the top importers reflect both mature consumption markets and growing production hubs.

European Union – Market Share: 30.9%

The EU remains the world’s largest importer of denim fabric, bringing in over USD 1.08 billion worth in 2024. Buyers in countries like Germany, Spain, and Italy demand certified, high-quality denim—often from Turkey, Pakistan, and India. The region’s strict environmental and social compliance standards make traceability and sustainability key factors in sourcing decisions.

United States – Market Share: 24.3%

The U.S. imported about USD 850 million in denim fabric, driven by consistent demand from jeans, workwear, and lifestyle brands. Most imports are routed via Mexico (under USMCA) or Asian suppliers. Buyers prioritize price, consistency, and lead time, making supplier reliability essential.

Japan – Market Share: 9.1%

With denim deeply embedded in Japanese fashion culture, the country imported approximately USD 320 million in 2024. Japanese buyers are known for their focus on selvage, premium, and indigo-rich fabrics, often sourced from specialized mills around Asia.

Vietnam – Market Share: 8.0%

As a major garment manufacturing hub for global fashion brands, Vietnam imported USD 280 million in denim fabric. The country has limited domestic fabric production capacity, leading to sustained import reliance—especially from China, Pakistan, and India.

Mexico – Market Share: 7.1%

Mexico’s denim imports reached around USD 250 million in 2024, largely used in cut-make-trim (CMT) operations for U.S.-based brands. The country’s proximity to North America and free-trade benefits keep it a vital node in the Western Hemisphere’s denim value chain.

In summary, 2024’s denim import market reflects strategic sourcing shifts, with buyers seeking not just fabric, but flexibility, compliance, and regional logistics advantages.

4. 2024 Denim Trade Snapshot: Global Denim Export vs Import Comparison Table

The table below presents a direct comparison of the top global denim fabric exporters and importers by trade value and market share in 2024. It helps stakeholders understand the structure and scale of the denim supply chain in real terms.

5. Key Trends in Denim Fabric Trade 2024: Sustainability, Speed, and Compliance

In 2024, global denim fabric trade is increasingly shaped by shifting consumer expectations, regulatory changes, and the urgent need for agility in global supply chains. Four dominant trends are driving this evolution:

- Eco-Denim Demand Rising

Sustainability is no longer a differentiator—it is a baseline expectation. Global buyers are actively seeking eco-friendly denim fabrics, especially those made from recycled cotton, organic fibers, and Tencel™ blends. Additionally, there is growing demand for fabrics produced using water-saving dyeing techniques, low-impact finishing, and reduced chemical inputs. Mills that can offer transparent environmental certifications (such as GRS, GOTS, or Oeko-Tex Made in Green) are gaining a competitive edge in both mature and emerging markets.

- Shorter Lead Times & Nearshoring Preferences

The pressure to reduce lead times has intensified as fashion cycles become shorter and demand for fast replenishment grows. In response, many European and U.S. brands are shifting sourcing to nearshore denim suppliers—with Turkey (for EU) and Mexico (for U.S.) gaining significant traction. These regions offer both geographical proximity and strong manufacturing capacity, enabling faster delivery without compromising quality.

- Compliance Pressure Intensifies

Social and environmental compliance has become non-negotiable for global sourcing teams. Buyers now require denim suppliers to meet multiple compliance standards, including OEKO-TEX®, GOTS, BCI, and even SLCP or Higg Index benchmarks. Factories that lack proper documentation, transparency, or traceability are increasingly excluded from vendor lists, particularly when working with European, Japanese, or U.S. fashion groups.

- Sourcing Diversification and Risk Mitigation

The post-pandemic landscape, along with rising geopolitical uncertainty, has led brands to re-evaluate single-country sourcing strategies. Many are diversifying their supply chains across multiple regions to reduce reliance on one origin, improve resilience, and balance costs. This shift opens new opportunities for suppliers in South Asia, North Africa, and Southeast Asia to attract strategic buyers with unique offers and quick-response capabilities.

In short, the denim fabric trade in 2024 is defined by green innovation, speed-to-market, and rigorous compliance. Suppliers who can align with these priorities—and communicate them effectively—will be better positioned to grow sustainably in today’s competitive sourcing environment.

6. Opportunities and Risks for Denim Suppliers and Buyers in 2024

For Exporters:

– Invest in flexible MOQ programs and fast sampling.

– Position with sustainability credentials.

– Explore emerging buyers in North Africa and Latin America.

For Buyers:

– Monitor geopolitical changes that impact tariffs.

– Evaluate mill capability beyond pricing.

– Partner with mills offering consistent logistics and lead time reliability.

7. Strategic Insights for Denim Businesses: How to Compete in 2025

In the rapidly evolving global denim market, suppliers and sourcing teams must navigate a complex matrix of cost, speed, compliance, and innovation. Understanding regional strengths and adjusting positioning accordingly is critical for maintaining competitive advantage in 2025.

- China: Still the Volume Giant, but Under Pressure

China continues to lead the global denim fabric market in terms of total production volume and export capacity. Its strengths lie in deep vertical integration, stable infrastructure, and a massive portfolio of denim fabric varieties. However, Chinese mills are increasingly challenged by global buyers demanding faster lead times, more flexible MOQs, and environmentally compliant production. To stay competitive, leading Chinese suppliers are investing in AI-assisted dyeing, recycled blends, and greener finishing systems.

- India & Turkey: Flexible Developers for Mid-to-High-End Markets

Both India and Turkey are gaining ground in the value-added denim segment. Indian mills are expanding rapidly in printed denim, jacquard designs, and sustainable yarn blends, while Turkish suppliers attract European buyers with premium quality, shorter shipping routes, and design support. Turkey, in particular, excels in fast fashion fulfillment, often turning around samples and bulk orders within 3–5 weeks. These countries are ideal partners for brands seeking style flexibility without sacrificing compliance.

- Bangladesh & Vietnam: Dual-Role Players in Fabric + Garment Supply

As vertically integrated hubs, Bangladesh and Vietnam serve both as importers of denim fabric and as exporters of finished garments. Bangladesh is increasing its in-house weaving capacity, while Vietnam continues to act as a key assembly point for global brands. Their dual roles make them strategic choices for buyers looking to streamline sourcing, especially when fabric and garment production are linked within the same supply zone.

- Mexico & Pakistan: Stable, Cost-Effective Sourcing Options

Mexico remains a favored sourcing destination for U.S. brands due to USMCA benefits, regional proximity, and relatively fast delivery times. On the other hand, Pakistan provides competitive pricing, consistent quality, and strong vertical integration. Both countries are valued for their stability, predictable logistics, and ability to serve large-volume basic denim orders efficiently.

Bottom line: The denim businesses that succeed in 2025 will be those who can align cost-efficiency with agility, embrace sustainability, and communicate value-added services clearly. Understanding regional strengths and offering flexible, compliant, and fast solutions is no longer optional—it’s essential.

8. Future Outlook: Global Denim Fabric Market Forecast Through 2025–2028

Looking ahead, the global denim fabric market is poised for steady expansion, driven by rising consumer demand for sustainable fashion, advancements in textile technology, and evolving sourcing behavior. The market is expected to grow at a compound annual growth rate (CAGR) of 5.7% through 2028, potentially adding over USD 724 million in new market value during this period.

As denim brands and mills respond to economic shifts, climate policies, and digital transformation, several high-impact trends are expected to shape the next three years:

- Digital Sourcing Platforms Will Reshape the Buying Experience

Traditional sourcing cycles—marked by in-person meetings, long sampling phases, and multiple iterations—are being replaced by smart, digital platforms. These tools allow buyers to search, filter, and request denim fabrics online, view 3D fabric simulations, and even match color swatches digitally. Companies that invest in virtual catalogs, instant quotation systems, and sample tracking dashboards will significantly shorten their sales cycles and win over global buyers.

- Circular Economy Models Will Become Mainstream

The denim industry is moving away from linear production and disposal models toward circular systems, where waste is minimized and materials are reused. Mills are increasingly incorporating recycled cotton, regenerated fibers, and post-consumer denim waste into new fabrics. Expect to see growth in closed-loop manufacturing, take-back programs, and zero-waste production processes—particularly among brands targeting Gen Z and ESG investors.

- AI and Automation Will Drive Quality, Customization, and Speed

Artificial intelligence and automation will play a growing role across the denim supply chain—from AI-powered fabric inspection systems that detect defects in real time to automated CAD software that enables custom weaves and precise pattern development. Smart weaving machines, IoT-enabled looms, and real-time data tracking will reduce waste, improve consistency, and open the door to mass customization at industrial scale.

- Consumer-Driven Design Will Influence Fabric Innovation

With the rise of DTC (direct-to-consumer) brands and on-demand production, denim fabric suppliers will need to adapt faster to micro-trends. Expect more collaboration between mills and fashion designers, using real-time sales data and trend analytics to develop limited-edition collections, custom textures, and influencer-driven finishes.

- Regionalized Supply Chains Will Continue to Emerge

Amid geopolitical uncertainty and rising freight costs, more brands will pursue regionalized or dual-sourcing strategies. This trend favors suppliers in Turkey, Mexico, North Africa, and Southeast Asia, who can offer shorter delivery windows and faster market access. Strategic location will increasingly become a competitive advantage, particularly for buyers targeting seasonal or fast-fashion collections.

In summary, the denim fabric market from 2025 to 2028 will be shaped by digital innovation, circular manufacturing, and intelligent supply chains. Denim businesses that embrace technology, sustainability, and speed—not just in words, but in execution—will define the next generation of global leaders.

9. Conclusion: Key Takeaways from the 2024 Global Denim Fabric Trade Report

2024 marks a transitional year for the global denim fabric trade. Export powerhouses like China, India, and Pakistan maintain their lead, while emerging sourcing hubs diversify global supply lines.

As the market pivots toward sustainability and digital efficiency, both exporters and importers must align with shifting expectations. The winners in denim sourcing will be those who can combine speed, compliance, and innovation into a scalable model.

Explore more denim insights from ZEVA DENIM:

– How to Choose the Right Denim Supplier for Your Brand

– Denim Fabric Certifications Explained: OEKO-TEX, BCI, and More

– Trends in Stretch vs Rigid Denim: What’s Driving Demand

Visit https://www.zevadenim.com/ for more.